Check out the latest news on laws and regulations.

How Much Is a Dollar Worth in Argentina?

Spoiler I : there are 19 correct answers –

Spolier II: Follow the latest news about How much is a Dollar Worth in Argentina, after President Mile Executive Order 70/23.

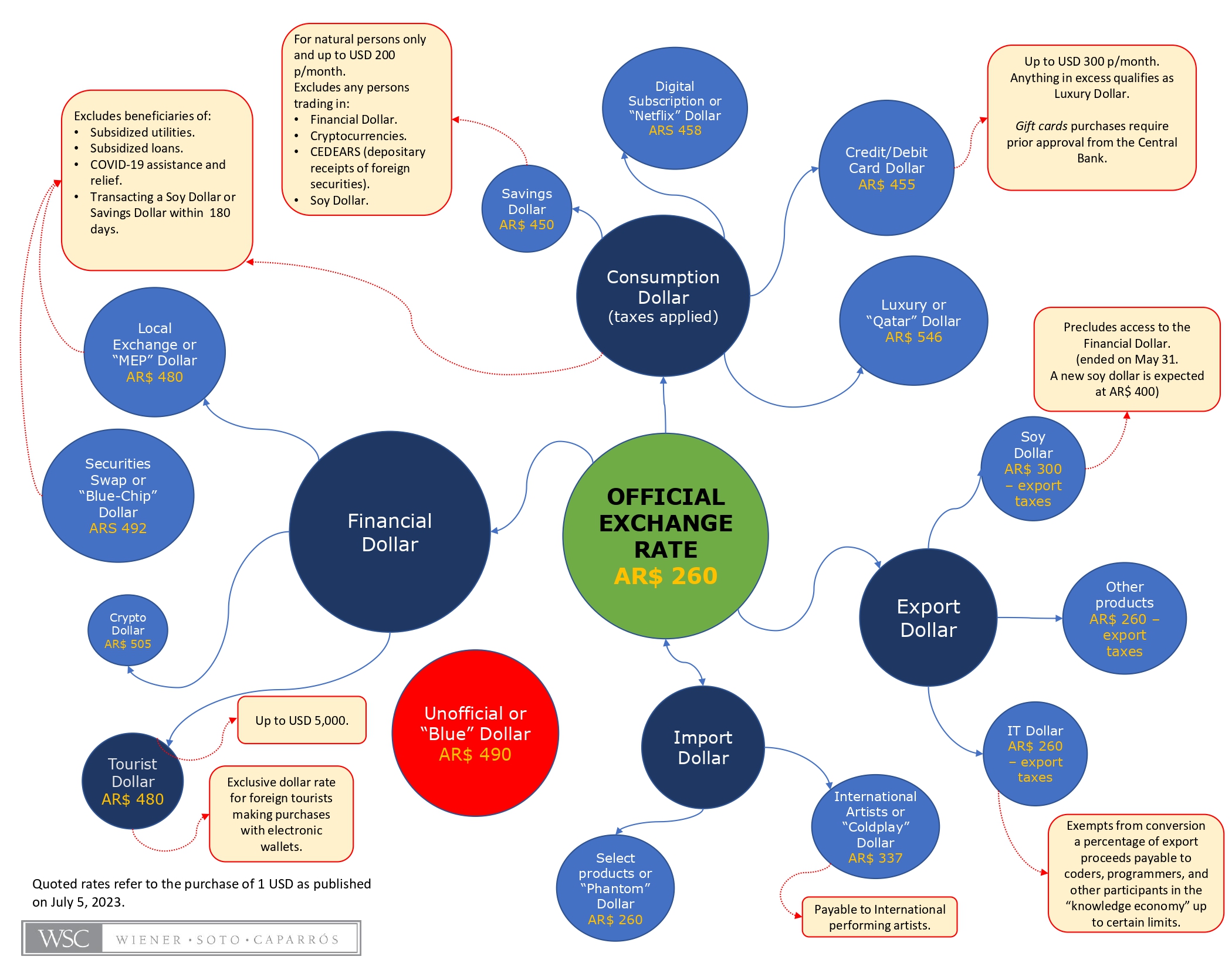

In the intricate web of Argentina’s foreign exchange controls, the once straightforward value of a dollar has splintered into a perplexing array of 19 distinct rates. This bewildering assortment of rates, highlighted in a graphic accompanying this article, illustrates the complexity of Argentina’s economic milieu. As inflation persists and the peso’s value dwindles, vendors continually adjust prices, navigating this labyrinth of exchange rates.

Argentina’s Return to Foreign Exchange Controls

Since September 2019, Argentina has returned to using currency controls to suppress capital outflows. Along with various other government policies, this has fanned multiple exchange rates for the coveted U.S. dollar. Initially, there were two rates: The official rate (applicable to the Argentine banking system and import-export transactions) and the market or blue rate (the rate charged by the unlicensed moneychangers to move funds in and out of Argentina).

Blue is the New Black

As financial suppression rules increased to staunch remittances, the government made it impossible for residents to obtain dollars to pay dividends, to service related-party obligations, or to repay cross-border loans. As a result, alternative mechanisms used during the previous era of foreign exchange clamps (2011-2015) resurfaced:

- The “Blue-Chip Dollar”: The exchange rate for the purchase of dollar-denominated securities and the transfer of those securities abroad to a counterparty.

- The “Local Exchange Dollar”: The exchange rate for the purchase of dollar-denominated securities held in Argentina.

The Blue-Chip Dollar and the Local Exchange Dollar (referred to in the graphic as “Financial Dollars”) hover around double the cost in pesos compared to the official exchange rate.

For a Few Dollars More (But Not at the Same Foreign Exchange Rate)

Argentine residents were quick to spend on foreign goods and services priced at the official exchange rate. To compensate for the leakage, the government taxed these purchases. The “Consumption Dollar” in the graphic encapsulates four distinct exchange rates: the “Netflix” Dollar (for foreign subscription services, taxed at 8%), the Credit Card Dollar (for purchases on an Argentine bank card) and the Luxury or “Qatar” Dollar (introduced at the time of the World Cup for purchases over US$300), and the Savings Dollar (the price applied to natural persons allowed to acquire up to US$200 per month for savings).

Farmers Pay More

Argentina has historically relied on grain exports to keep its economy going. As the official exchange endured, exporters increasingly preferred to store supplies until a more favorable exchange rate could be had. To entice exporters to sell, the government adopted a series of “special” rates for exporters of soy, corn, and other agricultural commodities, beef, wine, leather, and technology. These are the so-called “Export Dollars.”

It’s the Foreign Exchange Restrictions, Stupid

The government’s stubborn insistence on a creeping adjustment of the currency has spawned this hydra of exchange rates.

The following graphic illustrates the myriad foreign exchange rates operating in the current Argentina economy. Persistent inflation and an absurdly complex system of exchange rates has lead vendors to continuously raise prices, as the peso continues to lose value. During this election year, do not expect things to change!

More information

If you would like to discuss this matter with the attorneys at Wiener Soto Caparros, please do not hesitate to contact our author.

.

Disclaimer

This article is based on publicly available information and is for informational purposes only. It is not intended to provide legal advice or an exhaustive analysis of the issues it mentions.

.